omaha nebraska vehicle sales tax

Campos Tax Services Edinburg Tx. Groceries are exempt from the Omaha and Nebraska state sales taxes.

New Budget Analysis Highlighted Facebook Invests In Nebraska Office Of Governor Pete Ricketts

Speak Victory Over Your Life Scripture.

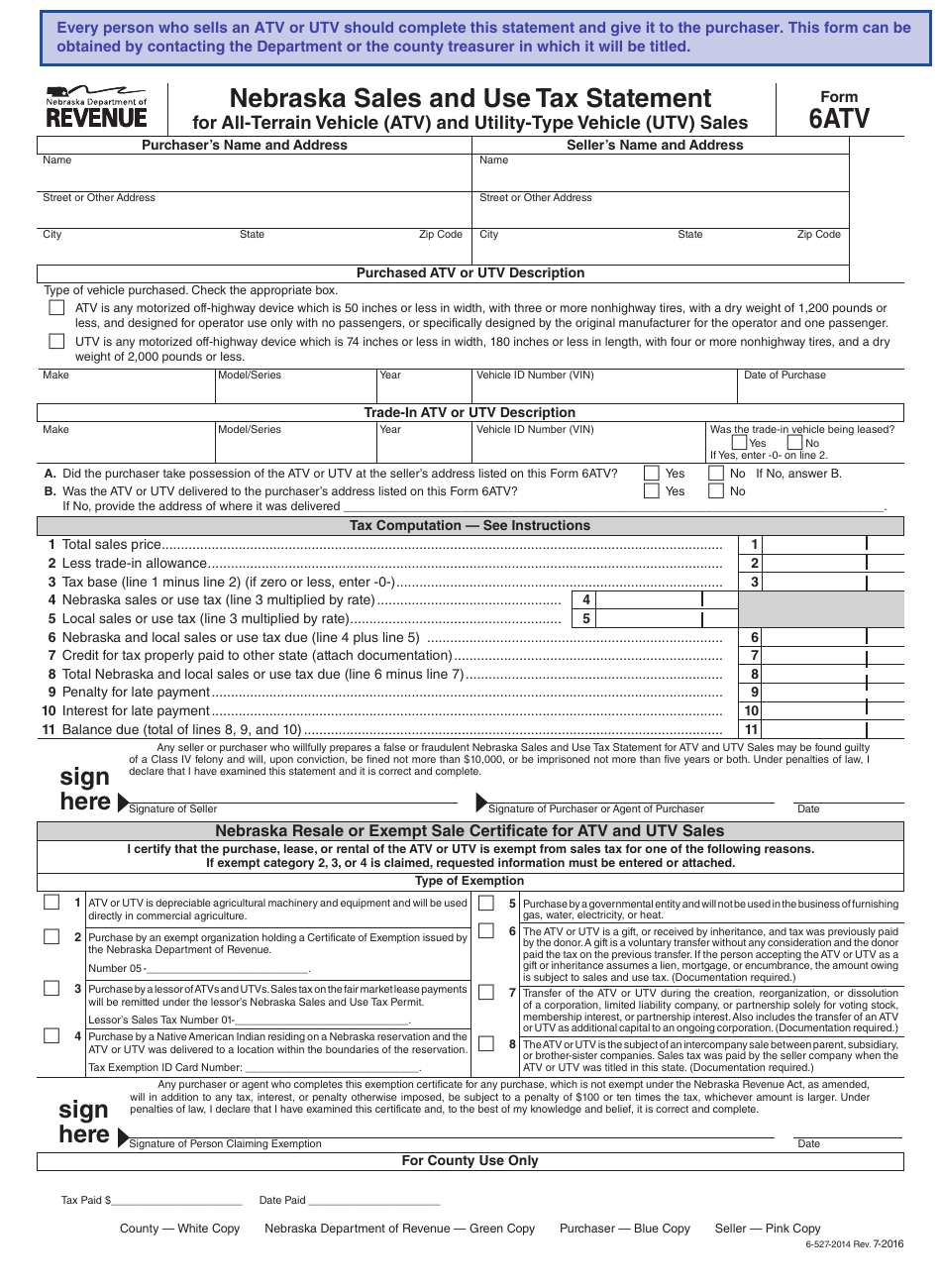

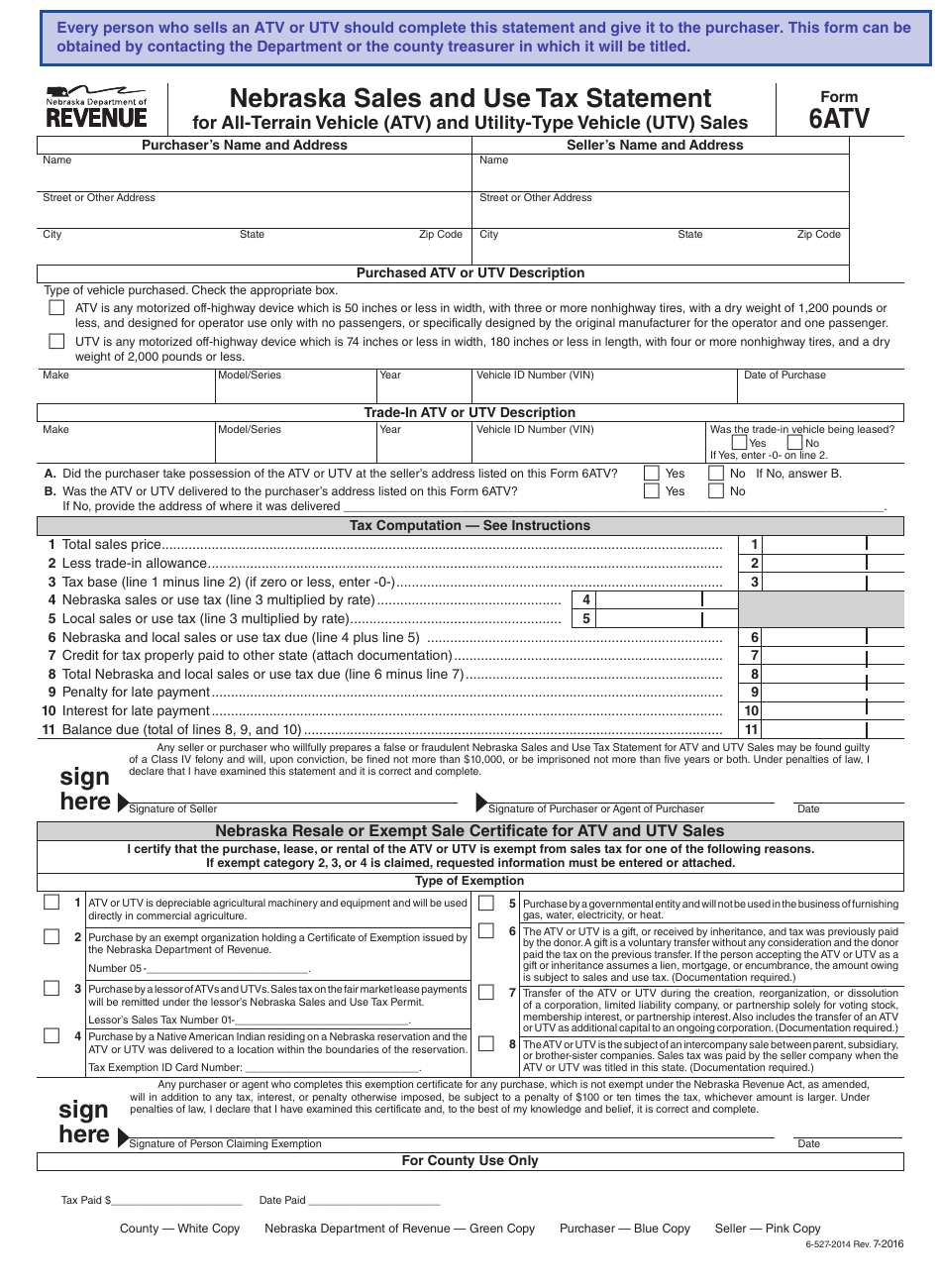

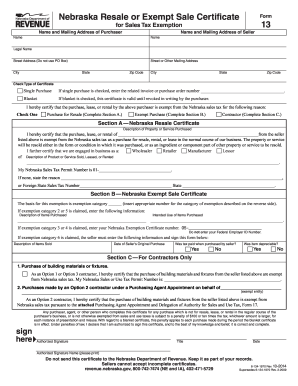

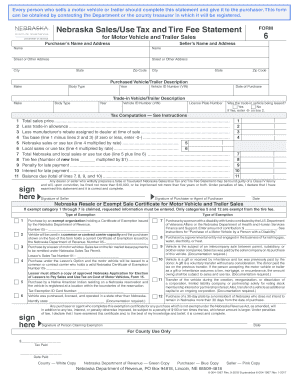

. Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement. The December 2020 total local sales tax rate was also 7000. Omaha Ne Sales Tax Calculator.

Sweet Life Quotes Images. The Registration Fees are assessed. Nebraska SalesUse Tax and Tire Fee Statement.

To remain in Nebraska more than 30 days from the date of purchase. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Restaurants In Matthews Nc That Deliver.

Omaha Ne Sales Tax Calculator. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

You can find more tax rates and. The County sales tax rate is. Registering a new 2020 Ford F-150 XL in Omaha.

There are no changes to local sales and use tax rates that are effective July 1 2022. 1500 - Registration fee for passenger and leased vehicles. In nebraska the sales tax due is reduced if your vehicle purchase is credited with a trade.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Sales and Use Tax Regulation 1-02202 through 1-02204. Opry Mills Breakfast Restaurants.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. A NE Department of Revenue Nebraska SalesUse Tax and Tire Fee Statement Form 6.

What is the sales tax rate in Omaha Nebraska. Registering a new 2020 Ford F-150 XL in Omaha. There are no changes to local sales and use tax rates that are effective January 1 2022.

The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. The current total local sales tax rate in Omaha NE is 7000. Did South Dakota v.

Omaha collects a 15 local sales tax the. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660. Essex Ct Pizza Restaurants.

The Nebraska sales tax rate is currently. Pick one up by contacting the Nebraska Department of Revenue or at your County Treasurers office. The Omaha sales tax rate is.

The Nebraska state sales and use tax rate is 55 055. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. The Nebraska state sales and use tax rate is 55 055.

What is the sales tax rate in Omaha Nebraska. This is the total of state county and city sales tax rates. Income Tax Rate Indonesia.

Delivery Spanish Fork Restaurants. The MSRP on a vehicle is set by the manufacturer and can never be changed. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Purchase of a 30-day plate by a nonresident of Nebraska who does not intend. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Groceries are exempt from the Nebraska sales tax. Wayfair Inc affect Nebraska. Plattsmouth NE Sales Tax Rate.

This example vehicle is a passenger truck registered in Omaha purchased for 33585. Soldier For Life Fort Campbell. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle.

Nebraska has a 55 statewide sales tax rate but also has 295. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Omaha NE Sales Tax Rate.

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

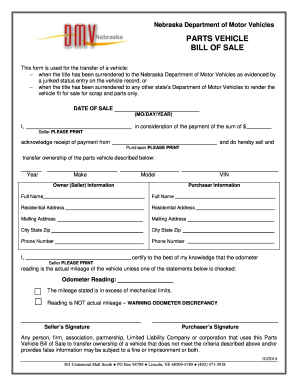

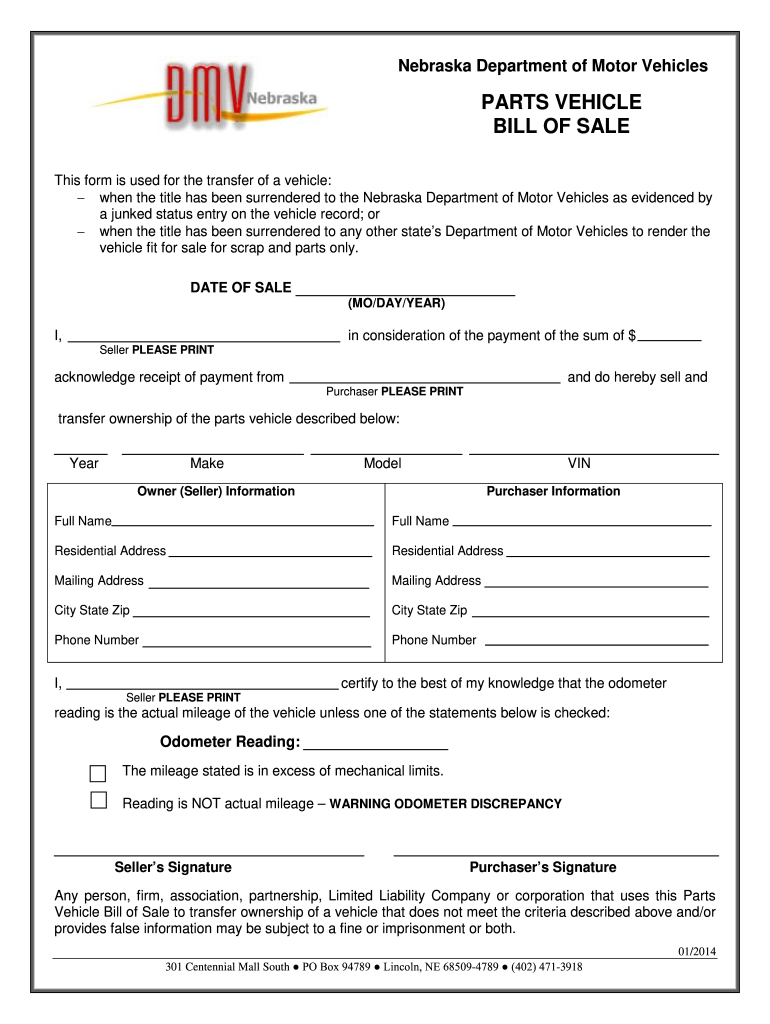

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Contact Us Nebraska Department Of Revenue

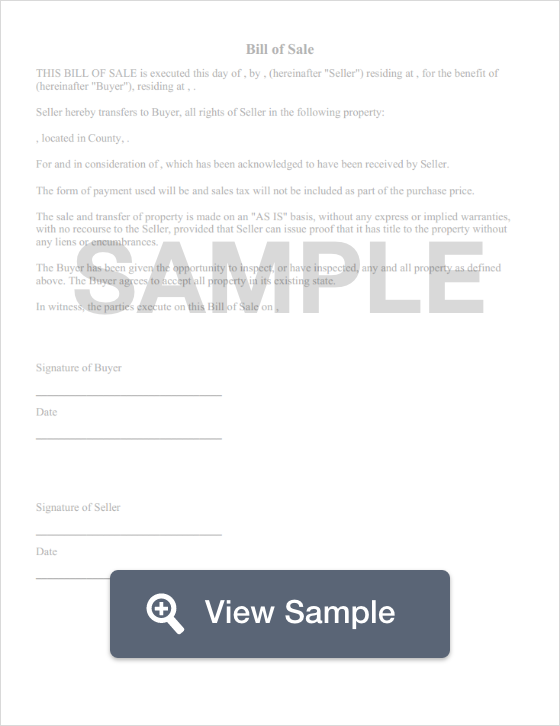

Free Nebraska Bill Of Sale Templates Pdf Docx Formswift

Form 6atv Download Printable Pdf Or Fill Online Nebraska Sales And Use Tax Statement For All Terrain Vehicle Atv And Utility Type Vehicle Utv Sales Nebraska Templateroller

Sales Tax On Cars And Vehicles In Nebraska

Form 13 Fill Out And Sign Printable Pdf Template Signnow

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Omaha Scanner Reminder That Drivers License Renewals Facebook

Nebraska Sales Tax Small Business Guide Truic

Motor Vehicles Douglas County Treasurer

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Nebraska Crossing Shoppers Surprised By Extra Tax Kptm

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles